Tax Compliance for Africa's SMEs: A Strategic Approach

Navigate the complexities of tax registration and compliance across African markets with expert guidance for sustainable business growth.

Tax Compliance for Africa's SMEs: A Strategic Approach

In Africa's fast-evolving business landscape, small and medium enterprises (SMEs) are the beating heart of economic growth, employment, and innovation. However, when approached strategically, compliance with national tax authorities can unlock access to funding, contracts, and legitimacy. As African economies modernize and digitize their tax systems, SMEs that stay ahead of requirements will position themselves for sustainable success --- both locally and globally.

At Genesis Management Consultancy, we believe that strategic tax compliance should be a central pillar of business planning --- not an afterthought.

Understanding the Challenge

African SMEs face a mix of obstacles that make tax compliance difficult:

Key Challenges: - Limited awareness of tax laws and filing obligations - Inconsistent recordkeeping or informal financial management - Inconsistent enforcement by tax authorities - Lack of affordable tax advisory services tailored to SMEs - Perceived high cost of being compliant versus staying informal

In countries like Zimbabwe, South Africa, Zambia, and Kenya, tax authorities are modernizing rapidly. Digital filing platforms like eFiling (South Africa) or ZIMRA's e-services are now the norm. The pressure is mounting for SMEs to keep up --- or risk penalties, blacklisting, or missed business opportunities.

Why Tax Compliance Matters

Far beyond avoiding penalties, being tax-compliant offers SMEs critical strategic benefits. Access to Government and Corporate Tenders requires a tax clearance certificate. Also, compliance builds trust and improves access to funding. Influencing Credibility with Banks and Investors. As your business expands, Regulatory Alignment ensures smoother scaling.

The African Tax Terrain

Navigating Africa's tax environment requires an understanding of the continent's wide-ranging fiscal regimes, shaped by economic diversity, levels of digital infrastructure, and administrative efficiency. Across Africa, Personal Income Tax (PIT) and Corporate Income Tax (CIT) rates vary significantly --- not just by percentage, but in how they are enforced, collected, and integrated into broader compliance ecosystems. Value-Added Tax (VAT) continues to be a critical revenue stream for African governments.

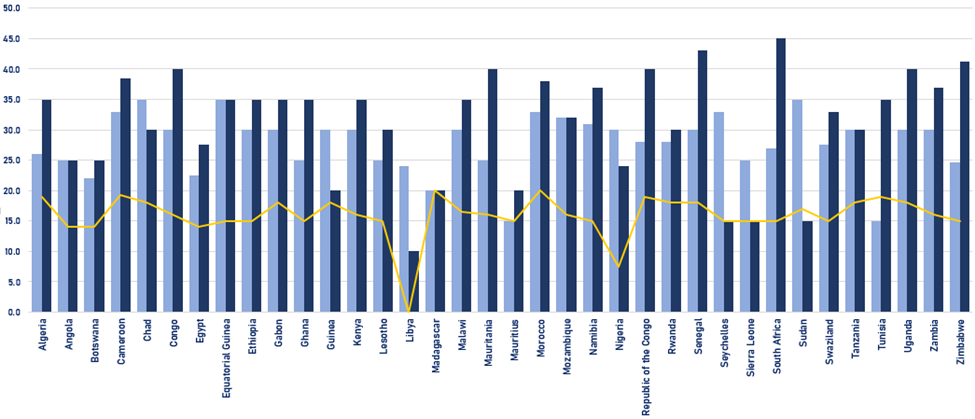

The Headline -- PIT and CIT rates for a number of African nations are tabulated below. These rates broadly align with global benchmarks and reflect the growing emphasis on structured fiscal policy across the continent. For any business operating in Africa --- whether locally rooted or internationally expanding --- a clear understanding of applicable tax heads is essential for compliance, planning, and sustainable growth.

While the figures shown represent standard rates, it's important to note that taxation can vary by industry or sector. For example, Gabon imposes a 35% CIT rate on companies in extractive industries (such as oil & gas and mining), compared to a 30% rate for general businesses.

This chart is intended solely as a general guide. It does not constitute professional tax advice, and we encourage businesses to consult qualified advisors --- such as Genesis --- for jurisdiction-specific guidance.

The table above shows standard tax rates as of 2024. Remember that rates may change and special provisions may apply to certain industries or business activities.

Key: CIT = Corporate Income Tax, PIT = Personal Income Tax, VAT = Value Added Tax Countries with notably low corporate tax rates: Tunisia (15%), Mauritius (15%) Countries with notably high personal tax rates: South Africa (45%), Zimbabwe (41.2%)

Strategic Steps Toward Tax Compliance

For African SMEs, tax compliance should be integrated into the business model --- not treated as an afterthought. Here's how:

Register Early and Correctly

Ensure the business is registered with both the company registrar and relevant tax authorities (e.g., ZIMRA, SARS, etc.)

Understand Your Obligations

Identify which taxes apply: income tax, VAT, PAYE, withholding tax, etc. Get clarity on filing schedules

Adopt Digital Bookkeeping

Use basic accounting systems or software to track revenue, expenses, and transactions. Cloud-based options make it easier for growing businesses

Partner with a Compliance Expert

Outsourcing compliance to a credible firm like Genesis helps avoid missteps while keeping you updated on regulatory changes

Stay Ahead of Deadlines

File returns and pay taxes on time. Late penalties are avoidable, and consistent compliance builds long-term credibility

How Genesis Helps SMEs Stay Compliant

At Genesis Management Consultancy, we support SMEs across Southern Africa and beyond with:

Services Include: - Business and tax registration - Monthly and quarterly tax filings (VAT, PAYE, income tax) - Tax clearance certificate processing - Advisory on cross-border tax issues - System setup for compliant bookkeeping and financial reporting

Tax Technology & The Future of Compliance

African tax authorities are adopting AI, data matching, and digital audits. This means informal businesses are increasingly visible --- and compliance will no longer be optional. SMEs that build tax readiness into their operations will enjoy long-term benefits and stability.

Related Insights

Stay Updated with Our Latest Insights

Subscribe to our newsletter to receive regular updates on business trends, strategic insights, and exclusive content.